|

|

|

|

|

|||

|

|||

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Car Breakdown Insurance Companies: Coverage Guide for U.S. ConsumersCar breakdown insurance is a crucial aspect for many U.S. drivers looking to protect themselves from unexpected repair costs. This coverage ensures peace of mind and financial savings by covering a range of potential vehicle issues. Understanding Car Breakdown InsuranceCar breakdown insurance, also known as mechanical breakdown insurance, provides coverage for vehicle repairs that result from mechanical failures. This type of insurance is particularly beneficial for those with older cars or vehicles that are out of the manufacturer’s warranty period. Key Benefits

What Does Car Breakdown Insurance Cover?Coverage can vary between insurance companies, but generally includes:

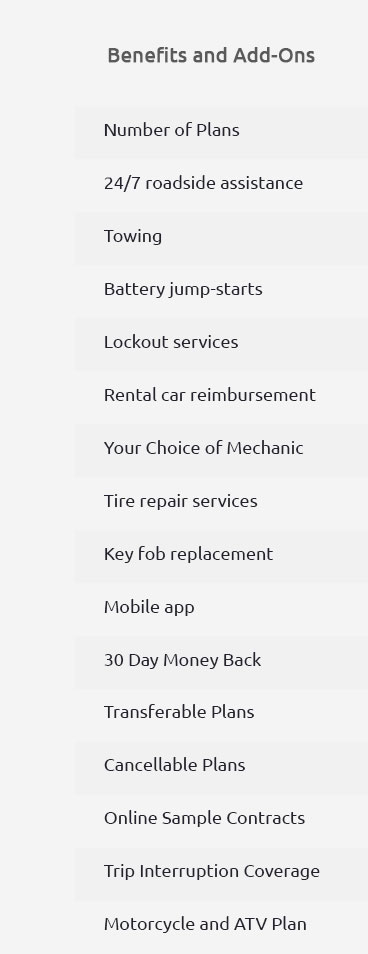

It's important to carefully review your policy to understand what is and isn't covered. For more detailed insights, you can check resources like car engine insurance. Choosing the Right CompanyWhen selecting a car breakdown insurance provider, consider:

For those in locations like California, where driving distances can be long, having reliable coverage is especially critical. Many local drivers opt for policies that emphasize extensive towing and roadside assistance options. FAQsWhat is car breakdown insurance?Car breakdown insurance covers repair costs associated with mechanical failures in your vehicle. It's an alternative to extended warranties and offers coverage for components like the engine and transmission. How does it differ from a car warranty?While a car with warranty typically offers coverage from the manufacturer for a set period or mileage, breakdown insurance can extend this protection or provide it for older vehicles not covered by a warranty. Is breakdown insurance worth it for older cars?Yes, it is often worth considering for older vehicles as they are more likely to experience mechanical issues, and the cost of repairs can be significant. Ultimately, choosing the right car breakdown insurance company can provide invaluable protection and peace of mind on the road. https://www.benzinga.com/money/mechanical-breakdown-insurance

The Best Mechanical Breakdown Insurance Companies - 1. Best Value for Money: Endurance (VSC) - 2. Best Customer Service: Carchex - 3. Best for Claims: Mercury ... https://www.carchex.com/content/mechanical-breakdown-insurance/

Generally, mechanical breakdown coverage is added to your policy as an endorsement. Car insurance endorsements, sometimes called riders, are ... https://www.reddit.com/r/Insurance/comments/k22rtx/what_insurance_companies_offer_mbi_major/

What insurance companies offer "MBI" - Major Breakdown Insurance? ... car insurance. You select deductible rate & what you want covered. Other Available Options

|